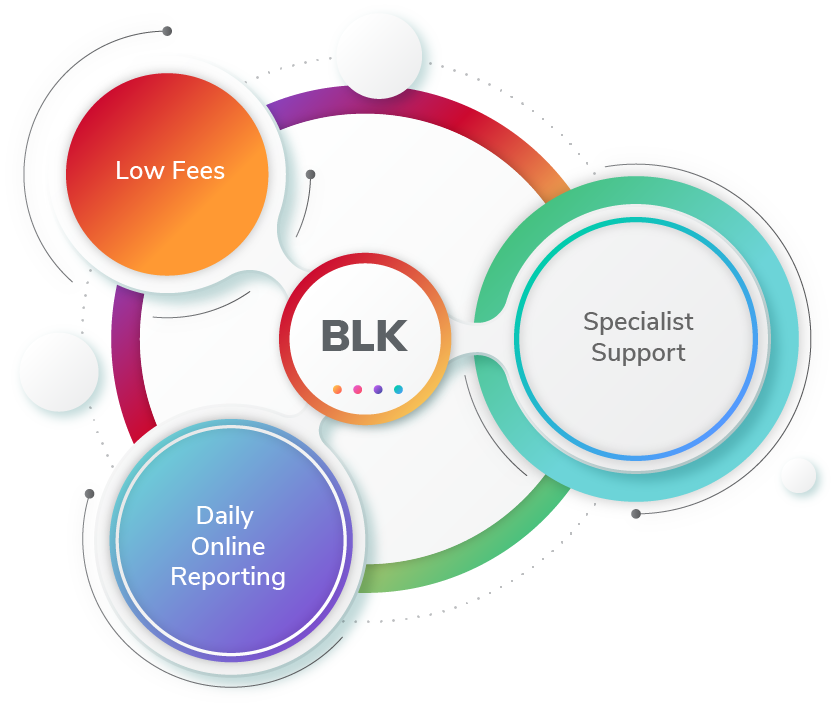

Xpress BLK

XpressBLK for extra support

Xpress Super have been leading the way in low cost SMSF administration for many years. Having such a committed client base has allowed us to collect valuable feedback.

Born from this feedback, we have developed XpressBLK, a unique service among low-cost providers.

XpressBLK builds on the systems that Xpress Super has already mastered, and offers experiences and access that will help you take your SMSF to the next level.

What do you get with XpressBLK?

- Your own SMSF qualified Client Manager

- Dedicated phone number for on-demand help

- Guaranteed 1 business day response times

- Technical and strategic support

- Priority scheduling of fund Financial Statements and Tax Return

- Online access to core fund documents

- Complimentary access for up to 2 SMSF seminars each year provided by SuperGuardian.

- All this in addition to the industry leading, low cost, online solution provided by Xpress Super.

How does XPRESSBLK compare?

Explore the advantages of levelling up your SMSF experience:

*$1,450/pa

*$1,150/pa

SMSF Establishment/Transfer

Daily Online Reporting

Monthly Account Reconciliations

Online portal messaging

Online access to core documents

Dedicated Client Manager (SMSF Specialist Adviser)

Direct email and phone line

Face-to-Face meetings (inc Zoom)

1 Business Day Responses

On-demand Technical and Strategic support

2 Complimentary SMSF Seminars each year

Proactive communication on useful strategies

Is XpressBLK suitable for me?

We know that everybody has different needs and desires, and we understand that this also applies to SMSFs.

Below we have provided a selection of common questions your dedicated Client Manager is asked and can assist you with.**

What contributions can I make?

Can Xpress Super help me with beneficiary nominations, investment strategy and other compliance documents?

What income is taxed inside my SMSF?

I am nearing retirement. When can I start a pension?

Can I contribute after I start a pension?

What is the unused concessional carry forward contribution strategy?

What are the eligibility criteria to utilise the non-concessional carry forward contribution strategy?

What age limits apply to contributions to an SMSF?

What is the difference between a binding and non-binding death benefit nomination?

How does a reversionary pension differ to a beneficiary nomination?

How are the pension withdrawal requirements calculated?

How does tax apply to my pension withdrawals?

What withdrawals are applied against my required pension drawdowns?

Can I have insurance inside my SMSF?

Can my SMSF purchase shares from me?

Can my SMSF borrow money?

Are there additional requirements to borrow money?

How is my SMSF taxed on international investments?

What is peer-to-peer lending?

Can I store my SMSF precious metal investment at home?

I want to buy a rental property in my SMSF. Where do I start?

I am suffering financial hardship, can I use my super?

Can Xpress Super help with the process of splitting my superannuation balance due to marriage breakdown?

What assets can my SMSF purchase from me?

Can my SMSF participate in a property development?

Can my SMSF hold life insurance for me?

Can I hold life insurance in a fund other than my SMSF?

How has my tax payable/refundable been calculated?

How do I add or remove members?

Can I change my trustee structure?

A member of my fund has passed, what do I do?

What is a bare trust and why is it needed?

What name do I put on an investment property purchase for my SMSF?

We are moving overseas, what do we need to consider?

What are the benefits of a corporate trustee vs individual?

I need guidance to setup my new SMSF

I want some guidance moving my SMSF administration to Xpress Super

How do I rollover funds into my SMSF?

How often should I update my trust deed?

How often should I review my investment strategy?

* Additional fees may apply. View our fees page for further detail on fees and to read our Financial Services Guide.

Looking to Establish an SMSF or Transfer an existing SMSF?

Talk to one of our experts, we’re here to help!

We are open: Monday – Friday 8:30 AM – 5:00 PM (ACST)

Adelaide

65 Gilbert Street

Adelaide SA 5000